CalNonprofit Webinar: Public Service Student Loan Forgiveness

For many of us who work in the nonprofit sector and have degrees in higher education, it is likely — and common — that we are slaves to the devil: Student Loan Debt. Here at EAP SFBA, we often discuss the sustainability or lackthereof within the nonprofits. Do nonprofits provide employees with realistic, livable wages? Are higher degrees required for these positions, and do those wages account for the cost of obtaining that education? Lastly, what resources can we provide each other with to help decreasing our debt?

With that said, we listened in on CalNonprofit’s webinar on Public Service Student Loan Forgiveness. Among the many payment plans and programs that are there to aid us, the Public Service Student Loan Forgiveness program (PSLF) has gained traction. Here’s a quick introduction:

We heard from four presenters to help foster awareness of the resources available to us: Natalia Abrams and Cody Hounanian of Student Debt Crisis; Maggie Thompson of Higher Ed, Not Debt, and Diana Dunker from CalNonprofits. This hour and a half webinar was jam-packed with information! Though they have provided a recording of the presentation, we at Emerging Arts Professionals have synthesized our notes on the main three components this webinar was designed to cover.

-

Who is Eligible?

There are three buckets of eligibility: Payment, Loan, and Employment.

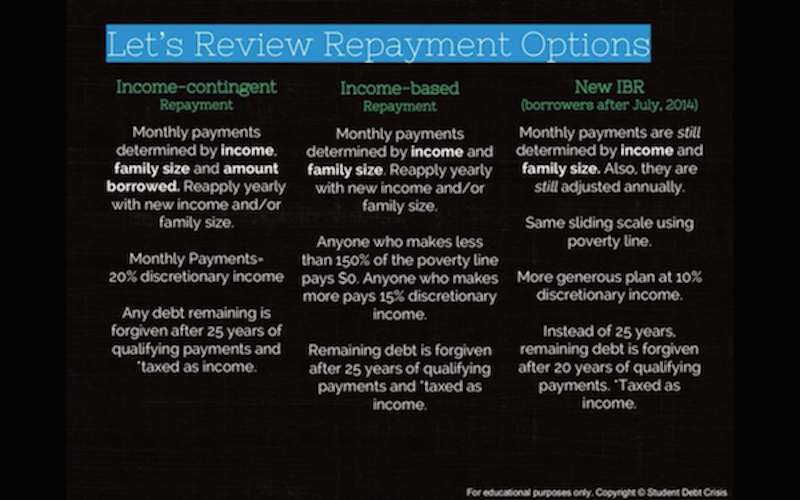

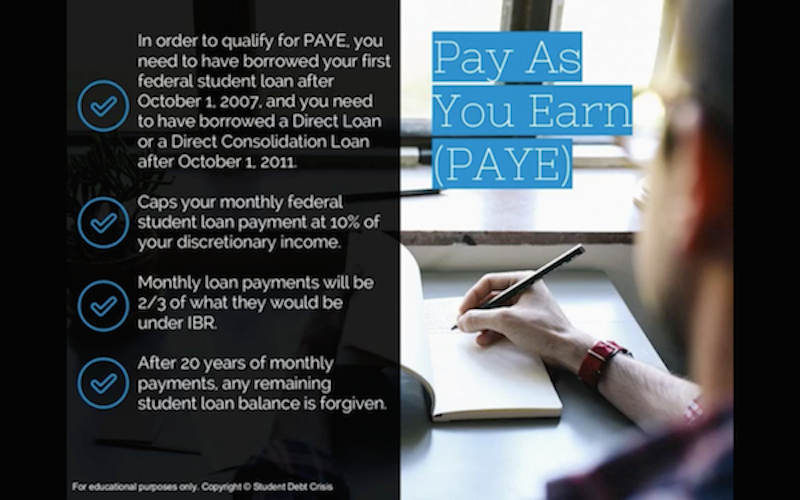

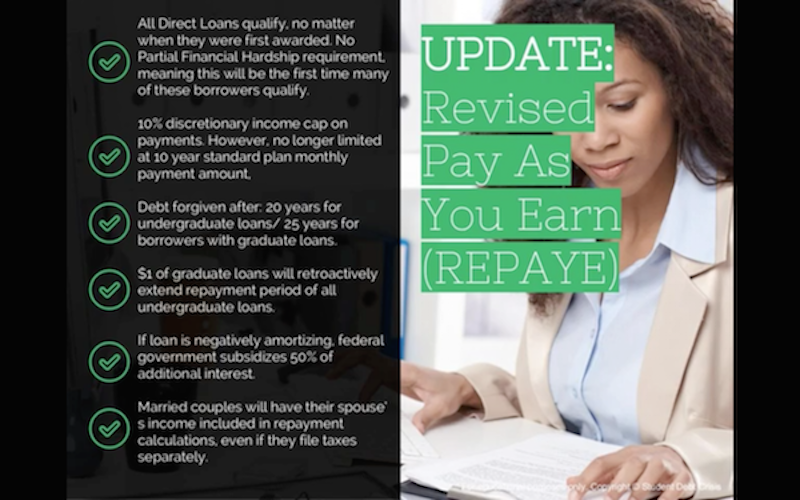

Payment eligibility requires individuals to make 120 monthly payments. They must be scheduled, paid in full and on time each month. Scheduled payments are those that are made while in repayment, not in deferment, in-school or grace status, or paid ahead in prepayment. Participants in the PSLF program must be enrolled in qualified payment plans: 10-year Standard repayment plan (SRP); Income Contingent Repayment (ICR); Income Based Repayment (IBR); or Pay as you Earn or the Revised PAYE plan (PAYE/RePAYE).

Loan eligibility deems that only Direct Loan Program loans that are not in default are eligible for PSLF. Loans received under the Federal Family Education Loan (FFEL) Program, the Federal Perkins Loan (Perkins Loan) Program, or any other student loan program are not eligible for PSLF. If you are unsure or cannot remember which kind of loan you have, you can always look it up on the National Student Loan Data System. Also, if you have previously consolidated your loans, then you must start your 120 eligible payments from the time of consolidation.

Employment eligibility requires participants to be a hired employee, working full-time for a qualifying organization. A qualifying organization is a Federal, State, or local government agency, entity, or organization or a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code (IRC).

-

Loan Repayment Options

The same payment plans required for the payment eligibility are the same options once enrolled in the PSLF Program, aside from the 10-year Standard Repayment Plan. Here’s a quick breakdown on the following: ICR, ICB, PAYE and RePAYE.

-

How to Apply

Now, the easy step. Once you have figured out whether or not you qualify and have your ducks in order, all you have to do is fill out the PSLF Employment Certification form! This can be printed, filled and submitted to the U.S. Department of Education FedLoan Servicing at P.O. Box 69184, Harrisburg PA 17106-9184, or faxed to 717-720-1628. Note that Section 4 of the form must be filled out by your employer.

While this only begins to scratch the surface, we encourage you all to dig into the rich resources to help reduce student loan debt! Below are some links that we found are useful, and if you have an extra hour and a half to spare, we recommend listening to the webinar. We thank CalNonprofits for hosting and for the presenters for sharing their expertise!

Additional Resources:

National Education Association’s Public Service Awareness FAQ’s

http://www.nea.org/home/60605.htm

Public Service Loan Forgiveness Certification Form (Section 8 goes into detail of requirements)

https://studentaid.ed.gov/sa/sites/default/files/public-service-employment-certification-form.pdf

National Student Loan Data System

Higher Ed, Not Debt

Student Debt Crisis

Full recording of the webinar:

https://calnonprofits.app.box.com/s/8spbum0tur4trbbfqensvwr1f1j9yhuk